Non Directional Trading method is a

Options Selling System - What is Options Selling then?

Most Options trader buy a call if they think (predict)

market is going up or buy a put if they think (predict)

market is doing down. If you are a Options trader and you have

been buying options then who is selling the options to you?? The

Professional Elite Trader (I am one of them) of course.

Why aren't you selling Options??

Have you ever heard that most futures options expire

worthless? The Chicago Merchantile Exchange estimates over 80%

of all options sold expire worthless. So why aren't you selling

them instead of buying them?

Benefits of Option Selling - Time Value Decay this is the

only reason why the Professional Elite Trader sell options to

you

When selling (or writing) an option, time value works for you

instead of against you. The buyer of the option pays you a

premium for that option. If you sell an out of the money option,

the entire value of that option has is time value. As time

passes, if the market behaves favorably, the option will

gradually lose it's value and expired worthlessly.

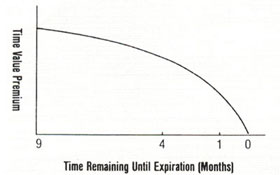

The graph above illustrates the principle of time decay and

it's acceleration as expiration draws near. An option is

considered a "wasting asset." Time value erodes as each day

passes, accelerating as the option's expiration nears. This is

referred to as time-decay. If the underlying contract does not

move far enough by expiration, the option will have no value

left and expire worthless and the option seller will keep the

premium. Notice that the value decays the fastest during the

last 30-60 days of the option's life.

Being Close Is Good Enough

By selling options, you avoid the game of trying to predict

where prices will go. Instead you are projecting where you think

prices won't go. For instance, if you are bullish a market, you

would sell an out of the money put option. In this case, the

market can move up, stay the same or even move down, as long as

it is above your strike price upon expiration, you will still

take your full profit.

What about the Risk Involved? My broker advised me not to

Sell Options as it is too risky

Did you ever make money listening to your broker? A short

option carries the same risks as a futures contract with one

major exception: It will generally move slower than a futures

position. This gives a trader more time and latitude to exit

should the market move against his option. Your Liberty Trading

Broker will work with you in determining the risk parameters of

each trade and which positions may be right for you.

Even though we believe selling options can potentially put

the odds of success in your favor, it still requires good, solid

market analysis. The difference is, selling options gives you a

larger margin for error. You don't have to be as exact as in the

futures market, only close.

Does this system has any losing trade? How big is the

losing trade?

No trading system is perfect and to tell you I have no losing

trade I will be lying. My success rate for the system is 95%. I

will show you a real example later in which I did a Soybean

trade. The profit if I have made is $200. But the trade did not

turn out well and I cut my losses and lose $100. That is a 2 : 1

risk and reward and with a 95% hit rate what more do you expect.

Occasionally I will have a 1 : 1 risk reward but hey it is still

a good system

The Good news is with this new found method:

- Collect Premium every time you initiated a

trade (The Amount you sold will be credited to your trading

account the moment you sell a Options whether it is a spread

or not as long as it is a credit.

- Trade like a Bookie and win 95% of the

time

- Make money predicting where the market

will not go. Which is easier predict where the market

will go or predict where the market will not go?

- Make consistently income between 5% - 15%

every month

- Less Stress

- Perfect Timing is no longer a crucial part

in trading